- GORNIK translators for industry GmbH

- Blumenstraße 12, 4484 Kronstorf

- info@gornik.at

- +43 7225 810 82-0

ESG reporting: What you need to know in 2024

Interview with sustainability expert Dr. Josef Baumüller, postdoctoral researcher at the Institute of Management Science (Finance and Controlling research area), TU Wien.

- What is ESG reporting?

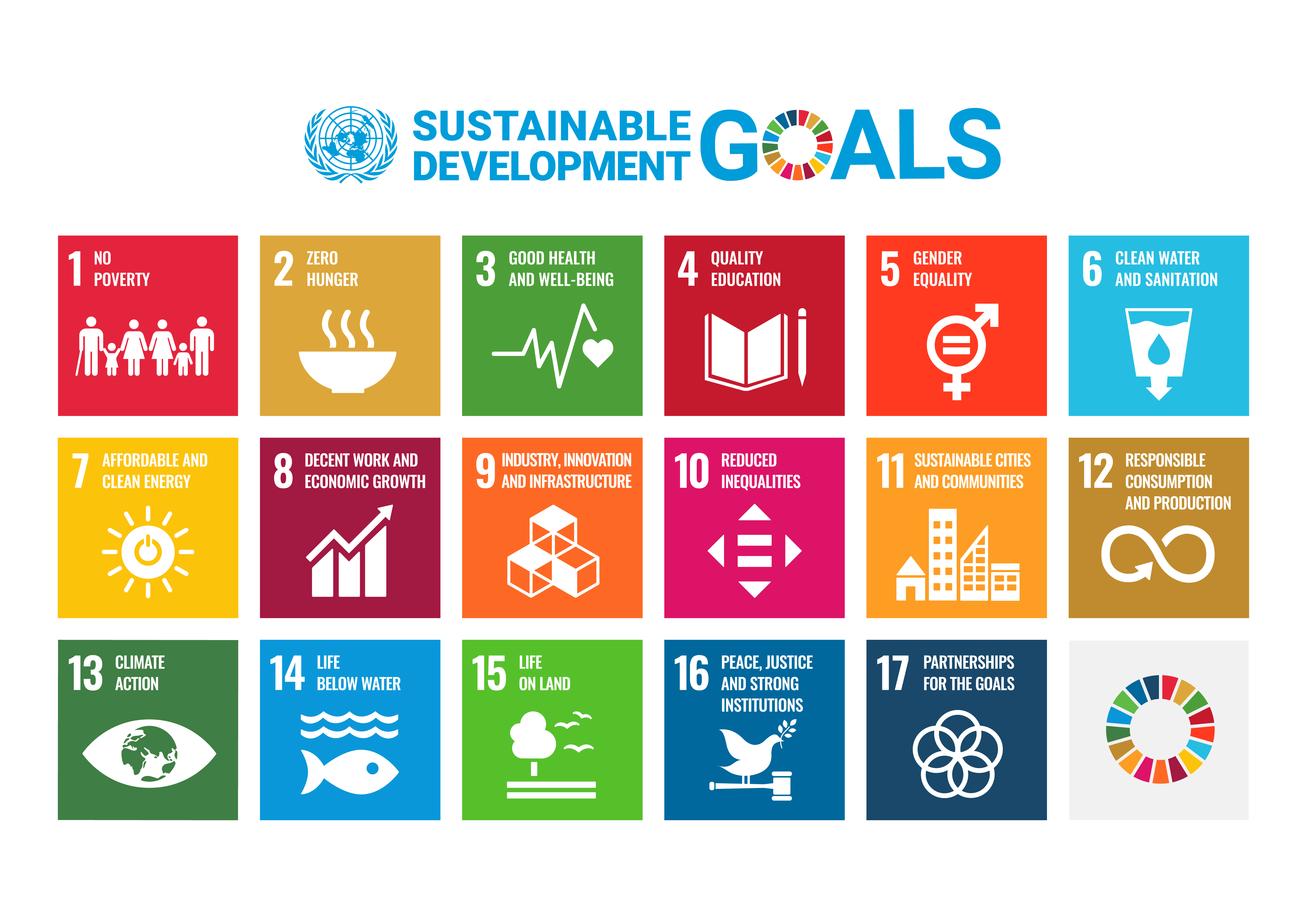

ESG stands for environmental, social and governance. It deals with core themes of sustainability as we understand it today. As for 'reporting', this generally refers to company reporting. ESG reporting means that corporate reports, which have traditionally concentrated on finances, now need to cover additional factors, many of which are qualitative. In this way, the external stakeholders of a company, and ultimately wider society, benefit from a far more comprehensive account of the activities of companies and the effects thereof. Internally, there is greater awareness of these effects and how they are linked to the current situation of the company. The likely impact can then be taken into account when decisions are made – thereby striking a better balance between economic, environmental and social factors. Ultimately, ESG reporting is a key tool in terms of promoting behavioural changes in business for the long term.

- Why will ESG reporting be so important in 2024?

On 1st January 2024, a new EU directive – the Corporate Sustainability Reporting Directive (CSRD) – came into force. For the first time, the directive will introduce a broad-based ESG reporting obligation. In particular, all large corporations in the EU will be required to compile an annual sustainability disclosure as part of their management reports. This must set out the impact of their economic activities in full detail, and address the associated risks and opportunities. The report must make reference to clearly defined sustainability aspects such as climate protection, biodiversity and the company's own workforce. Given that the entire value chain of companies required to report must be examined and presented, many more companies will in fact be directly affected by the CSRD requirements. Companies will need to compile data for their business partners so that they can meet their reporting obligations; otherwise, they are likely to find it difficult to uphold those business relationships. In short, the CSRD is bringing sustainability reporting into the mainstream.

- What to do before commencing ESG reporting

An ESG report is merely the end product of a lengthy process with far-reaching consequences. First, a company must establish the necessary preconditions, starting with an analysis of the extent to which it is affected (directly or indirectly, on what levels, according to which standards?). Next, it is necessary to invest – in know-how and the relevant tools. ESG reporting will keep companies busy throughout the year, posing conceptual, legal and practical questions for the persons responsible. Answering these points properly will take a lot of time. On top of this comes an aspect that will keep companies occupied for years on end: the necessary data management. Companies need to know what data is required, to what level of detail, and how to collect that data efficiently and reliably. In the end, CSR reports and the data and processes on which they are based will be inspected and certified by an external auditor. It is therefore important to have a clear plan on how to approach this long and challenging journey from the outset.

- What your ESG report must include

The new European Sustainability Reporting Standards (ESRS) constitute a key element of the CSRD. These standards set out the required content of reports in great detail. Alongside the sustainability considerations that need to be covered (climate protection, etc.), the following aspects of sustainability are central to the report: policies, actions, metrics and targets.

Metrics must be defined, with the necessary data collected in turn. The associated policies, actions and targets are trickier: partly because there is more leeway here, but also because these points give rise to fundamental questions that go to the heart of the business model and which are especially important to many of the stakeholders who will carefully read the report at a later date. In other words, even the most elaborate sustainability report will be worthless if it has no basis of substance; sustainability must be woven into strategy and governance.

- My top three tips for compiling an ESG report

1) Approach ESG reporting as a project, applying the same gravity and sense of purpose you would bring to financial reporting. Make it clear that both forms of corporate reporting should be treated as equals.

2) Invest early and consistently. The present developments are unstoppable, and the aim is clear: you simply cannot afford to sleepwalk through them. What's more, the longer you delay taking the necessary steps, the greater the time pressure – which will entail higher costs while severely limiting the quality you can hope for.

3) Recognise the opportunity that ESG reporting presents. Firstly, bear in mind what is at stake: no less a goal than saving the planet. Surely there are less important goals you could pursue! At the same time, fresh needs will emerge on markets well beyond the EU's borders as quality criteria are redefined. All of this has the potential to open up new opportunities from various perspectives – including the business perspective.

- ESG reporting mistakes to avoid

Thinking an ESG report is just a marketing gimmick, only good for greenwashing. Such objections are understandable, and unfortunately may have been justified in the past. However, those days are gone. Today it's all about the legitimacy and future viability of your business model and your ability to provide appropriate answers on sustainability factors to your stakeholders via ESG reports – while drawing your own conclusions from such information as necessary.